Filipinos, it would seem, are bad savers. We spend conspicuously on everything—from dining out and watching movies to incessantly shopping online—yet many attest to family and friends that they actually live from paycheck to paycheck.

The numbers and data don’t lie either. The World Bank’s 2017 Global Findex Database affirmed that 66 percent of Filipinos do not have a savings account. Further studies even show that one in five Filipinos still think they do not need a savings account, and of those who do want to save with a bank, 18 percent said they did not have the necessary documents and 10 percent felt it was too expensive to open an account.

For a developing country, these numbers are alarming as it signifies that a majority of Filipinos—especially those in underserved sectors—are not practicing one of the most basic tenets of financial wellness, and that is saving up money.

There are many other barriers to consider, such as the lack of financial institutions in remote and rural areas, as well as the strict requirements and expensive fees in opening a savings account. Filipinos may be fully aware that saving is important in securing their financial security, but unfortunately, do not have the means to do so.

Luckily, with our continuously evolving digital landscape, more accessible financial and banking options are being made available to the average Filipino. Mobile technology, especially, has been taking leaps to bring financial inclusivity to the underserved.

Mobile wallets such as GCash have managed to provide an effective solution to bring financial solutions to more and more Filipinos across the country. Financial transactions such as sending and receiving money, paying monthly bills and even paying for purchases in stores can all be done through the application.

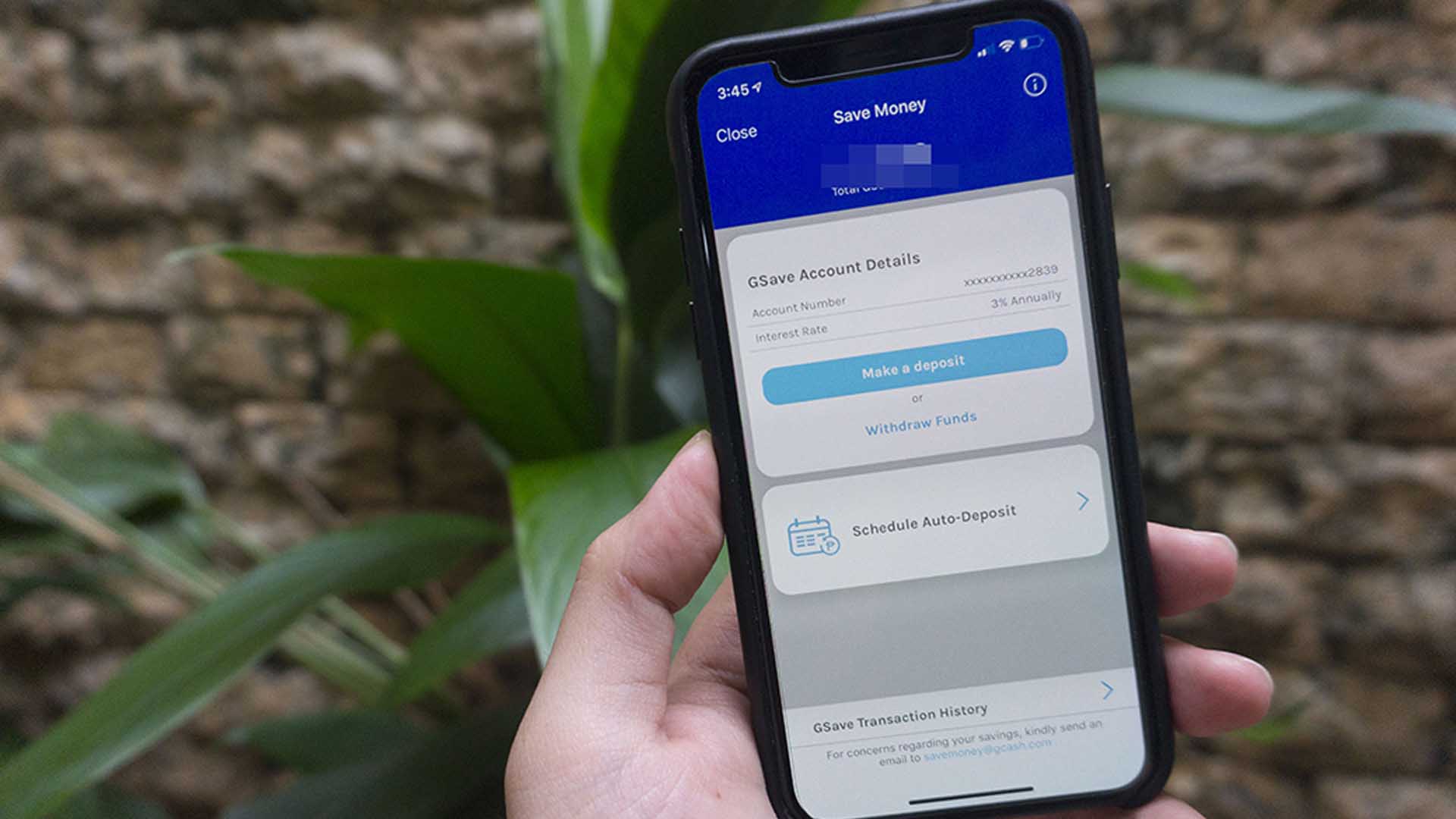

And now, the struggle of many Filipinos with financial saving is also being addressed by the country’s leading mobile wallet. The introduction of GCash Save, in partnership with digital-first Malaysian Bank CIMB, lets Filipinos open their own mobile wallet savings account, which can earn up to 12 times higher than current industry rates, without a minimum deposit or a required maintaining balance—a stark difference compared to banks requiring at least a P5,000.00 initial deposit. What many have perceived to be a tedious process can now be conveniently and easily done using a mobile phone.

Thanks to GCash’s advanced features, the shift to a digital savings platform is becoming even more enticing to Filipinos. For one, it’s highly convenient as GCash Save users can deposit and take out money anytime, anywhere through convenient cash-in and cash-out options such as proceeding to partner outlets or linking their GCash with traditional bank accounts.

Users also enjoy higher-than-industry interest rates for savings. With lower operating costs from not having physical branches, GCash Save is able to provide as high as 3 to 4 percent interest rate to their customers, which goes a long way in helping make their money grow.

Last, GCash goes through lengths to ensure that the mobile banking experience on the platform is safe and secure. Added features such as GCash Customer Protect assure users of compensation from cases of fraud or unauthorized transactions on the app due to mobile phone theft or other untoward incidents.

With GCash Save, you get to help save the environment as well. No paper billing means zero waste, since all transactions are done online.

With mobile innovations like the GCash Save app being made more available for the masses, it definitely won’t be long until we see more Filipinos getting into the habit of saving and being more financially secure—taking the easy, convenient and rewarding digital path to financial wellness.